This special edition of Summit Perspectives provides an in-depth explanation of the new Summit Re partnership with Zurich American Insurance Company for catastrophic medical excess of loss business across all product lines.

Read moreAbout Zurich

Zurich Insurance Group (Zurich) is a leading multi-line insurer that serves its customers in global and local markets. With more than 55,000 employees, it provides a wide range of general insurance and life insurance products and services. Zurich’s customers include individuals, small businesses, and mid-sized and large companies, including multinational corporations, in more than 170 countries. The Group is headquartered in Zurich, Switzerland, where it was founded in 1872. The holding company, Zurich Insurance Group Ltd (ZURN), is listed on the SIX Swiss Exchange and has a level I American Depositary Receipt (ZURVY) program, which is traded over-the-counter on OTCQX. Further information about Zurich is available at www.zurich.com. In North America, Zurich is a leading commercial property-casualty insurance provider serving the global corporate, large corporate, middle market, specialties and programs sectors through the individual member companies of Zurich in North America, including Zurich American Insurance Company. Life insurance and disability coverage issued in the United States in all states except New York is issued by Zurich American Life Insurance Company, an Illinois domestic life insurance company. In New York, life insurance and disability coverage is issued by Zurich American Life Insurance Company of New York, a New York domestic life insurance company. For more information about the products and services it offers and people Zurich employs around the world go to www.zurichna.com. 2012 marked Zurich's 100 year anniversary of insuring America and the success of its customers, shareholders and employees.

Zurich Financial Strength

Financial strength ratings (as of September 30, 2014): A.M. Best > A+/Stable

Standard & Poor's > AA-/Stable

Recognition and awards:

Zurich named “Best Insurance Company” (Captive LIVE USA Conference, October 2014)

2014 Innovation Award: “What if?” Zurich Risk Grading™ Application (Business Insurance, March 2014)

Zurich winner of the AGC Community Award (Associated General Contractors of America, Annual Conference, March 2014)

2014 Innovation Showcase: “Zurich Risk Room” and “My Zurich Portal” (Best’s Review magazine, January 2014)

Zurich “Best Political Risk Insurer,” “Best Global Supply Chain/Trade Disruption Insurer,” “Best Property Insurer,” “Best D&O Insurer,” “Best Employment Practices Liability Insurer,” “Best Crime/Fidelity Insurer” and “Best General Liability Insurer” (Global Finance Magazine, October 2013)

Zurich’s Trade Credit and Political Risk group named “Best Private Insurer in Trade,” “Best Trade Insurer in North America,” “Best Trade Insurer in Asia Pacific” and “Best Trade Insurer in Latin America” (Trade Finance, June 2013)

2013 Innovation Award: Zurich Risk Room Mobile Application (Business Insurance, March 2013)

2013 “Innovation in Fronting” Award: UK Captive Services Awards (Captive Review, February 2013)

Zurich named “Best Fronter of the Year” (Captive LIVE USA Conference, September 2012)

Zurich’s Trade Credit and Political Risk group named “Best Private Insurer,” “Best Trade Insurer in Asia Pacific” and “Best Trade Insurer in North America” (Trade Finance, August 2012)

Zurich named “2011 Insurer of the Year” (Daimler Financial Services AG, August 2012)

Innovation Award for Zurich Multinational Insurance Application (Zurich MIA) (Business Insurance, March 2012)

ERC / Westport Merger

Swiss Re has received regulatory approval to merge Westport Insurance Corporation into Employers Reinsurance Corporation. The merger is an example of Swiss Re’s focus on smart capital management, delivering greater efficiency and reducing operating costs. Reinsurance agreements issued after January 1, 2008 will bear the Westport name. There will be no changes in coverage as a result of the merger. If you have any questions, please contact Summit Re at 260-469-3000.

Employer Stop Loss Expansion

Summit Re has expanded its self-funded marketing and underwriting staff and opened regional offices to provide even better service to you.

Meet Allen Engen

Allen Engen joined us as Regional Vice President in July 2006. Allen has more than 14 years of experience in employer stop loss and health care risk management, specifically in underwriting and sales. He brings a tremendous amount of energy to Summit Re and has hit the ground running. Allen’s clients appreciate his focus on meeting their needs and his ability to seek solutions that may fall “outside the box.” When not at work, he is very active in Boy Scouts and enjoys golfing and fishing.

New Regional Offices

As part of our commitment to you and to the self-funded market, we opened two regional marketing and underwriting offices. Chris Alexander, located in Charlotte, NC, runs the Eastern Employer Stop Loss Office and Allen Engen, located in Minneapolis, MN, heads up our Western Office.

Premium check-up

The last thing any of us wants to hear is, “We’re going to be audited!” We all face scrutiny in one fashion or another—whether it’s CPAs examining our financial statements, the NCQA reviewing the quality of care provided to covered members, or maybe even the IRS checking our tax returns. On a different scale, Summit Re began a review process in 2006 to test the premium paid on its reinsurance and stop loss contracts. Typically, our clients submit premiums on a monthly basis using remittance statements we provide at the start of the agreement year. You simply fill in the number of members at the beginning of the month, multiply that by the applicable premium rates, and send payment for the result. And when it’s received by our accounting department, we review the statement for accuracy—to verify that the correct rates were used and to determine if the census fluctuated significantly from prior month—before forwarding it to the reinsurer. The same process is followed for both HMO reinsurance and stop loss premium.

But up until now, we’ve not tested the underlying data, the membership numbers used to calculate premium. Our reinsurers, in audits of our own operations, thought that such reviews make good business practice, and we agreed. While we trust our clients to submit the appropriate premium agreed upon in the contract, it still makes sense to verify it once in a while.

Now, we won’t visit every client, nor will we come calling every year. Rather, we’ll select a few each year for review and travel to your offices to examine the source documentation. While it’s tempting to schedule clients located in the south for review during February (after all, we are in Indiana), we’ll likely perform the reviews in the summer after the busy winter and spring activity have subsided. And we’ll promise that we’ll be as efficient as possible. Generally, all we need is a couple of days to complete our work.

So, there’s no reason to panic if you get a call saying that we’d like to come and verify your premium numbers…you can save that for when the IRS letter arrives!

Swiss Re Purchase of ERC

On June 10, 2006, Employers Reinsurance Corporation (ERC) was acquired by Swiss Re. Both Summit Re and ERC are excited about this business transaction, as it will increase our ability to provide you with the best financial security, expertise and service in the reinsurance industry. The transaction includes all of the Commercial Insurance operations of Employers Reinsurance Corporation. Swiss Re specifically sought to include the HMO reinsurance and employer stop loss product lines in this transaction and has plans to grow the Commercial Insurance operations.

Effective with the closing, the senior management of the Commercial Insurance division of ERC will remain in place, including Robin Sterneck, President, and Jeff Argotsinger, Vice President and medical excess product manager.

ERC, as a part of Swiss Re, will provide our customers with even more customized solutions. As a company focused solely on insurance and reinsurance risk worldwide, Swiss Re recognizes the value of building and growing customer relationships for the long term. Swiss Re is now the world’s largest reinsurance company in both property/casualty and life/health business.

As part of the transaction, General Electric, the former parent of ERC, has acquired 9% of Swiss Re shares and will have a board seat. GE is essentially taking a smaller share in a larger operation.

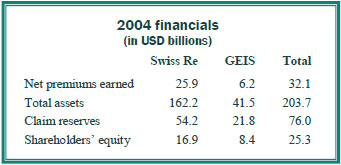

With this acquisition of ERC, Swiss Re took a strong balance sheet and made it even stronger. ERC is currently rated A by AM Best, and Swiss Re is A+. Below is a summary of the financials of the combined operation (2005 results were not yet available).

Summit Re and ERC have a long term agreement to underwrite catastrophic medical excess reinsurance together. We look forward to the opportunity to provide HMOs and other managed care plans with reinsurance through our exclusive relationship with ERC. Swiss Re management has re-approved our marketing plan, pricing / underwriting manuals and guidelines.

If you have any questions, please feel free to contact your Summit Re Regional Vice President or call Brian Fehlhaber at 260-469-3004.

A. M. Best Affirms ERC’s Excellent Rating

A.M. Best affirmed its “A” (Excellent) financial strength rating of Employers Reinsurance Corporation (ERC). The company assigned a stable outlook to its rating. In a press release dated March 31, 2005, Ron Pressman, president and CEO of GE Insurance Solutions, said “We are pleased that A.M. Best has acknowledged in our discussions the tremendous strength of our investment portfolio, our strong capital level, our market presence and GE’s substantial support.” For a copy of the complete press release, please contact Mark Troutman, president of Summit Re, at 260-469-3010 or mtroutman@summit-re.com.

New Staff Expands Summit Re’s Expertise

Summit Re and GE Insurance Solutions announced the hiring of three new managed healthcare reinsurance personnel in 2004. We are committed to hiring the personnel needed to expand our presence in the managed healthcare reinsurance marketplace and provide our customers unmatched service. We remain dedicated to this market and customers we serve. The addition of the following talents enhances an already strong team. John Broyles joined Summit Re on January 19. John formerly worked for Risk Based Solutions as a principal and founder. He is excited to be part of the Summit Re and ERC managed care reinsurance growth strategy. John will sell to and service health plans in selected regions as Regional Vice President, Sales.

Larry Jackson joined Summit Re on July 19. Larry is a former Lincoln Re employee with 18 years of experience in the healthcare actuarial arena, specifically employer stop loss and health plan reinsurance. He will underwrite managed healthcare and employer stop loss accounts and assist in the maintenance of pricing programs and managed care network analysis.

Deborah Stubbs joined Summit Re on September 7 as a managed care specialist. She is responsible for providing consultative case management services to our clients, assisting our underwriters in the assessment of potential catastrophic claims and leading the managed care vendor selection process. Debbie also meets with clients and prospects to explain our value-added managed care services. Debbie was most recently the Manager - Training and Education for the utilization management department of Kaiser Permanente of the Mid-Atlantic States.