Swiss Re has received regulatory approval to merge Westport Insurance Corporation into Employers Reinsurance Corporation. The merger is an example of Swiss Re’s focus on smart capital management, delivering greater efficiency and reducing operating costs. Reinsurance agreements issued after January 1, 2008 will bear the Westport name. There will be no changes in coverage as a result of the merger. If you have any questions, please contact Summit Re at 260-469-3000.

Secure Extranet

It makes good business sense to save money and time by reducing the amount of paper you use and by reducing costs associated with mailing and faxing. It is also importantto safeguard Private Health Information according to HIPAA privacy rules.

We have addressed those issues by introducing our secure extranet. You are now able to send us claims, underwriting data, and any other confidential information via the secure extranet. We are also now sending our clients quarterly premium and claims reports this way. The extranet accepts any type of document, including .zip and .pdf files.

To use the secure extranet, go to our website, www.summit-re.com, and select “Extranet-Login” from the top right side of the home page. If you have a username and password, you can send files to us and receive files from us through this web portal.

If you do not have a username and password, contact Kris Lahey at klahey@summit-re.com or call her at 260-469-3017. She will set you up with a username and password, instruct you on its use, and answer any questions you may have.

Employer Stop Loss Expansion

Summit Re has expanded its self-funded marketing and underwriting staff and opened regional offices to provide even better service to you.

Meet Allen Engen

Allen Engen joined us as Regional Vice President in July 2006. Allen has more than 14 years of experience in employer stop loss and health care risk management, specifically in underwriting and sales. He brings a tremendous amount of energy to Summit Re and has hit the ground running. Allen’s clients appreciate his focus on meeting their needs and his ability to seek solutions that may fall “outside the box.” When not at work, he is very active in Boy Scouts and enjoys golfing and fishing.

New Regional Offices

As part of our commitment to you and to the self-funded market, we opened two regional marketing and underwriting offices. Chris Alexander, located in Charlotte, NC, runs the Eastern Employer Stop Loss Office and Allen Engen, located in Minneapolis, MN, heads up our Western Office.

Premium check-up

The last thing any of us wants to hear is, “We’re going to be audited!” We all face scrutiny in one fashion or another—whether it’s CPAs examining our financial statements, the NCQA reviewing the quality of care provided to covered members, or maybe even the IRS checking our tax returns. On a different scale, Summit Re began a review process in 2006 to test the premium paid on its reinsurance and stop loss contracts. Typically, our clients submit premiums on a monthly basis using remittance statements we provide at the start of the agreement year. You simply fill in the number of members at the beginning of the month, multiply that by the applicable premium rates, and send payment for the result. And when it’s received by our accounting department, we review the statement for accuracy—to verify that the correct rates were used and to determine if the census fluctuated significantly from prior month—before forwarding it to the reinsurer. The same process is followed for both HMO reinsurance and stop loss premium.

But up until now, we’ve not tested the underlying data, the membership numbers used to calculate premium. Our reinsurers, in audits of our own operations, thought that such reviews make good business practice, and we agreed. While we trust our clients to submit the appropriate premium agreed upon in the contract, it still makes sense to verify it once in a while.

Now, we won’t visit every client, nor will we come calling every year. Rather, we’ll select a few each year for review and travel to your offices to examine the source documentation. While it’s tempting to schedule clients located in the south for review during February (after all, we are in Indiana), we’ll likely perform the reviews in the summer after the busy winter and spring activity have subsided. And we’ll promise that we’ll be as efficient as possible. Generally, all we need is a couple of days to complete our work.

So, there’s no reason to panic if you get a call saying that we’d like to come and verify your premium numbers…you can save that for when the IRS letter arrives!

Swiss Re Purchase of ERC

On June 10, 2006, Employers Reinsurance Corporation (ERC) was acquired by Swiss Re. Both Summit Re and ERC are excited about this business transaction, as it will increase our ability to provide you with the best financial security, expertise and service in the reinsurance industry. The transaction includes all of the Commercial Insurance operations of Employers Reinsurance Corporation. Swiss Re specifically sought to include the HMO reinsurance and employer stop loss product lines in this transaction and has plans to grow the Commercial Insurance operations.

Effective with the closing, the senior management of the Commercial Insurance division of ERC will remain in place, including Robin Sterneck, President, and Jeff Argotsinger, Vice President and medical excess product manager.

ERC, as a part of Swiss Re, will provide our customers with even more customized solutions. As a company focused solely on insurance and reinsurance risk worldwide, Swiss Re recognizes the value of building and growing customer relationships for the long term. Swiss Re is now the world’s largest reinsurance company in both property/casualty and life/health business.

As part of the transaction, General Electric, the former parent of ERC, has acquired 9% of Swiss Re shares and will have a board seat. GE is essentially taking a smaller share in a larger operation.

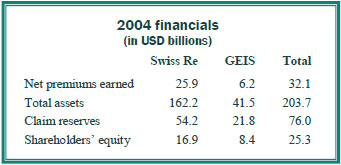

With this acquisition of ERC, Swiss Re took a strong balance sheet and made it even stronger. ERC is currently rated A by AM Best, and Swiss Re is A+. Below is a summary of the financials of the combined operation (2005 results were not yet available).

Summit Re and ERC have a long term agreement to underwrite catastrophic medical excess reinsurance together. We look forward to the opportunity to provide HMOs and other managed care plans with reinsurance through our exclusive relationship with ERC. Swiss Re management has re-approved our marketing plan, pricing / underwriting manuals and guidelines.

If you have any questions, please feel free to contact your Summit Re Regional Vice President or call Brian Fehlhaber at 260-469-3004.

Why Manage Chronic Disease?

Employers, insurers and federal lawmakers increasingly are focusing on early intervention for potential chronic diseases to avoid hospital admissions and complications later in the disease process. Disease management is one of the fastest-growing areas in health care.

Federal Efforts

The federal government launched a disease management initiative to test capitated payment arrangements with qualified organizations for the case management of specific diseases. The targeted populations include Medicare beneficiaries with chronic illnesses and special populations, such as those eligible for both Medicare and Medicaid and the frail elderly. Historically, a small proportion of Medicare beneficiaries has accounted from the major proportion of Medicare expenditures. In 1996, 12.1% of all Medicare enrollees accounted for 75.5% ($126.1 billion) of all Medicare fee-for-service program payments.1

Many of these beneficiaries have specific, chronic diseases and the majority of the care is for repeat hospitalizations. As the general population continues to age, the estimated cost of care for these individuals is expected to grow dramatically.

Private Sector Efforts

The level of interest regarding disease management is increasing. The Disease Management Association of America was formed to advance the practice of disease management and the National Association of Quality Assurance has established standards for disease management programs. Managed care organizations usually have some form of disease management programs in place, since there are clear incentives for managing care effectively. The programs may be internally developed or outsourced to a disease management vendor.

Program Features

The definition of disease management and the program objectives may vary, but there are certain features that are common to all programs:

- Identification of members and assessment of severity and the need for interventions

- Use of evidence-based practice guidelines

- Monitoring compliance with the plan of care

- Promoting patient self management

- Routine reporting and feedback with patients, physicians, the health plan, and ancillary providers

- Collection and analysis of process and outcomes data

Programs may include the use of information technology, such as specialized tracking and documentation software, data registries, automated decision support tools, and call-back systems.

Chronic Diseases

The majority of disease management vendors offer programs for asthma, diabetes, cardiovascular disease (congestive heart failure, hypertension), chronic obstructive pulmonary disease, maternity management (including high-risk pregnancy), and end stage renal disease.

Intervention

Levels of intervention are offered, ranging from distribution of educational information to frequent phone contact with patients and physicians. The level of intervention provided is based on the assessed needs of the patient. Many disease management vendors now offer predictive modeling as a part of their programs. The predictive modeling system can analyze data from a variety of health plan sources to identify the patients who are consuming the greatest portion of healthcare dollars and have the greatest potential for future complications and admissions. This information can then be used to focus disease managementefforts on patients who have the greatest need and who offer the potential for the greatest return on investment.

End Stage Renal Disease

Among the chronic diseases typically managed by disease management firms, the diagnostic group that is most likely to result in a reinsurance claim is end stage renal disease (ESRD) with resulting dialysis. The average monthly cost for an ESRD patient is $15,000 to $40,000. The average time on the kidney transplant waiting list is 5 years. In addition, the majority of these patients have co-morbid conditions, such as hypertension, diabetes and cardiovascular disease, which result in costly hospital admissions. Eight out of every 100 Americans have some form of kidney failure.2 By 2010, 725,000 people are projected to have ESRD and to need dialysis or a transplant.3 ESRD cost the U.S. health care system nearly $19.3 billion in 2000. Costs are projected to double by 2010.4,5 The management of ESRD patients can vary widely, so having an ESRD disease management program is beneficial to a health plan where this disease is prevalent in the population.

Sources:

- Federal Register Notices, Vol. 68, No. 40, February 28, 2003.

- NKF-K/DOQI estimate.

- USRDS 2003 ADR Report.

- Hostetter, NKDEP presentation, 2003

- Trivedi, et al, Am J K D, Vol. 39, No. 4, 2002

A. M. Best Affirms ERC’s Excellent Rating

A.M. Best affirmed its “A” (Excellent) financial strength rating of Employers Reinsurance Corporation (ERC). The company assigned a stable outlook to its rating. In a press release dated March 31, 2005, Ron Pressman, president and CEO of GE Insurance Solutions, said “We are pleased that A.M. Best has acknowledged in our discussions the tremendous strength of our investment portfolio, our strong capital level, our market presence and GE’s substantial support.” For a copy of the complete press release, please contact Mark Troutman, president of Summit Re, at 260-469-3010 or mtroutman@summit-re.com.

New Staff Expands Summit Re’s Expertise

Summit Re and GE Insurance Solutions announced the hiring of three new managed healthcare reinsurance personnel in 2004. We are committed to hiring the personnel needed to expand our presence in the managed healthcare reinsurance marketplace and provide our customers unmatched service. We remain dedicated to this market and customers we serve. The addition of the following talents enhances an already strong team. John Broyles joined Summit Re on January 19. John formerly worked for Risk Based Solutions as a principal and founder. He is excited to be part of the Summit Re and ERC managed care reinsurance growth strategy. John will sell to and service health plans in selected regions as Regional Vice President, Sales.

Larry Jackson joined Summit Re on July 19. Larry is a former Lincoln Re employee with 18 years of experience in the healthcare actuarial arena, specifically employer stop loss and health plan reinsurance. He will underwrite managed healthcare and employer stop loss accounts and assist in the maintenance of pricing programs and managed care network analysis.

Deborah Stubbs joined Summit Re on September 7 as a managed care specialist. She is responsible for providing consultative case management services to our clients, assisting our underwriters in the assessment of potential catastrophic claims and leading the managed care vendor selection process. Debbie also meets with clients and prospects to explain our value-added managed care services. Debbie was most recently the Manager - Training and Education for the utilization management department of Kaiser Permanente of the Mid-Atlantic States.

GE Insurance Solutions: Rebranding GE’s Employers Reinsurance

In September General Electric (NYSE: GE) announced it will unify the branding of its reinsurance and commercial insurance products and services as GE Insurance Solutions. "The name change is significant, yet it's the first step toward building a powerful brand, said Ron Pressman," Chairman, President and CEO. "Our brand is our promise to our customers that they will get world-leading risk expertise from dedicated people who build strong relationships by delivering unsurpassed customer service."

Pressman continued: "The foundations of our brand are in place. We've retooled the organization by our strong customer relationships and rededicating ourselves to delivering the kinds of solutions our customers need to succeed in their markets. With more than $50 billion in combined assets and $7 billion in statutory capital, this business has never been stronger financially or strategically."

The new brand name replaces Employers GE Re, Frankona Re, Westport Insurance and nearly a dozen other go-to-market names. However, insurance and reinsurance risks will continue to be underwritten by the existing legal entities, whose legal names will not change. GE Global Insurance Holdings is changing its name to GE Insurance Solutions Corporation.

The announcement of the new GE Insurance Solutions brand is part of an overall rebranding at GE, which is dramatically reducing its market-facing entities and names. GE Insurance Solutions is a group of companies that protects people, property and reputations. With more than $50 billion in combined assets, GE Insurance Solutions is one of the leading providers of commercial insurance, reinsurance and risk management services.