On June 10, 2006, Employers Reinsurance Corporation (ERC) was acquired by Swiss Re. Both Summit Re and ERC are excited about this business transaction, as it will increase our ability to provide you with the best financial security, expertise and service in the reinsurance industry. The transaction includes all of the Commercial Insurance operations of Employers Reinsurance Corporation. Swiss Re specifically sought to include the HMO reinsurance and employer stop loss product lines in this transaction and has plans to grow the Commercial Insurance operations.

Effective with the closing, the senior management of the Commercial Insurance division of ERC will remain in place, including Robin Sterneck, President, and Jeff Argotsinger, Vice President and medical excess product manager.

ERC, as a part of Swiss Re, will provide our customers with even more customized solutions. As a company focused solely on insurance and reinsurance risk worldwide, Swiss Re recognizes the value of building and growing customer relationships for the long term. Swiss Re is now the world’s largest reinsurance company in both property/casualty and life/health business.

As part of the transaction, General Electric, the former parent of ERC, has acquired 9% of Swiss Re shares and will have a board seat. GE is essentially taking a smaller share in a larger operation.

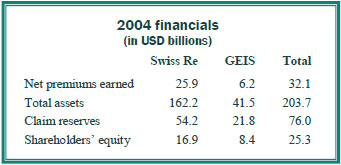

With this acquisition of ERC, Swiss Re took a strong balance sheet and made it even stronger. ERC is currently rated A by AM Best, and Swiss Re is A+. Below is a summary of the financials of the combined operation (2005 results were not yet available).

Summit Re and ERC have a long term agreement to underwrite catastrophic medical excess reinsurance together. We look forward to the opportunity to provide HMOs and other managed care plans with reinsurance through our exclusive relationship with ERC. Swiss Re management has re-approved our marketing plan, pricing / underwriting manuals and guidelines.

If you have any questions, please feel free to contact your Summit Re Regional Vice President or call Brian Fehlhaber at 260-469-3004.