To control the rising costs of providing a medical benefit program, some employers look to self funding. HMOs that can offer administrative services only (ASO) or affiliate with third party administrators (TPAs) can bring both a self-funded approach and managed care programs to employers.

Selecting an MGU

HMOs who participate in the employer stop loss market should carefully select a managing general underwriter (MGU) with expertise in both managed care reinsurance and the self-funded market. Your MGU should also have full-service capabilities. Summit Re is a full-service MGU focusing on HMOs who participate in the employer stop loss market. Our managed care experience sets us apart from traditional employer stop loss carriers and managing underwriters.

Pricing and Underwriting

Summit Re’s staff of underwriters and actuaries is dually equipped to understand this combination of funding and managed care savings. We apply our knowledge in the development of competitive stop loss rates and aggregate funding factors for your self-funded clients. As one of the market leaders in HMO excess reinsurance, we have a unique understanding of HMOs and their excess medical risk. We review not only your provider contracts, but also your managed care protocols and your HMO experience.

Sales Support

Summit Re takes an active role in helping you place self-funded business. We are a phone call away to discuss strategy on individual accounts. In unique situations, we can assist you in the on-site presentation of the stop loss proposal to the employer. Once a group is sold, we focus on servicing the account.

Integrated Administration

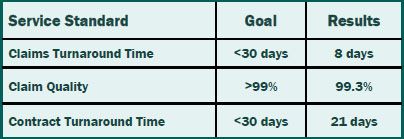

Our rating and proposal system is fully integrated with our stop loss contract production, premium collection, and claims payment modules. This results in proposal-based policy issued quickly, accurate premium accounting, and timely claim payments. We also have an experienced staff in each functional area to ensure that personalized service isn’t forgotten.

Risk Transfer Flexibility

Summit Re works with two carriers who provide the employer stop loss product: Companion Life Insurance Company and Presidential Life Insurance Company. These two carriers allow Summit Re to write this product in all 50 states.

If you want to retain some of the risk but do not have an insurance company, there are certain approaches we can use that allow you to assume a portion of the risk written by one of our insurance company partners and managed by

Summit Re.

If you have an insurance company to write the employer stop loss product, your carrier can keep some or all of the risk. Summit Re can provide some or all of the MGU services, or your insurance company can perform all the functions with Summit Re providing consulting services in specific areas.

Summit Re’s goal is to be creative, responsive and entrepreneurial, to help you meet your strategic goals for employer stop loss, whatever they may be!

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.