Metabolic health has been a hot topic for the last couple of years, and that trend looks to continue in 2026.

Read moreBreaking the Cycle: Preventing Neonatal Abstinence Syndrome and Nurturing Healthy Beginnings

When adults withdraw from opioids, we understand that withdrawal symptoms follow. The lesser-known fact is that infants who are born dependent on drugs have horrible withdrawal symptoms, too. The difference is that they are defenseless.

Read moreGoal: Reduce Inpatient Admissions

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. You may be aware of Summit ReSources' consultative case management and managed care programs, but what you might not know is that our Managed Care Specialist is available to perform an in-depth assessment of your own medical management practices and procedures. This helps you ensure that your medical management is effective and efficient, not only for the benefit of your bottom line, but it also may ensure optimal outcomes for your members.

Goal: Reduce Admissions

ABC Health Plan recently contracted with Summit ReSources’ Managed Care Specialist to perform an evaluation of its medical management department. The overall goal of the health plan was to shift away from intense inpatient utilization management and focus on outpatient case management. In other words, the health plan recognized the importance of implementing steps to prevent the inpatient admissions in the first place.

On-site Evaluation

An on-site evaluation included staff interviews and assessments of policies, procedures, processes, and computer systems. Some of the issues addressed included:

- Are the health plan’s policies and procedures consistent with the NCQA standards?

- Are staffing patterns consistent with national benchmarks?

- What is the most cost-effective way to perform utilization management?

- What are appropriate outcome measures for medical management?

- What key features should be included in a disease management program?

- Which members should be referred for disease and case management?

- What are appropriate measures for return on investment for disease management and case management?

- What key features should be included in a predictive model?

Recommendations

Recommendations were made related to maintaining only the utilization management process that would provide the greatest clinical and financial value to the organization.

Since ABC Health Plan did not have a well-developed case management program, specific recommendations for the development of such a program were provided, including but not limited to, examples of case management referral triggers, screening tools, acuity measures, and return-on-investment documentation.

Post evaluation, there were several additional phone conferences regarding implementation of the recommendations.

The feedback from ABC Health Plan was that the assessment and recommendations were “crucial” and “most helpful” in moving the process forward to meet the overall goals of the organization.

Summit ReSources is available to provide an evaluation of your medical management program. Whether you are a small or large managed care organization, eliciting an outside evaluation of your medical management efforts can be beneficial. Summit Re works with efficient, cost-effective health plans, but most understand the need for continual improvements in medical management given the rapid changes in health care.

Managing NICU Costs

This article is part of a series of case studies—real stories of how managed care companies increased profits by using Summit Re’s resources to increase sales, decrease expenses, and manage claims. Neonatal intensive care unit (NICU) costs, especially for managed Medicaid populations, are one of the top drivers of overall healthcare costs for health plans. The major reasons for the high NICU costs are a significant variability in NICU care patterns, continuous advances in NICU care which is often reflected by higher cost of care, and longer lengths of stay as premature infants are born younger and surviving, albeit with more complex care needs. So what is a health plan to do?

Summit ReSources, the Summit Re managed care department, works closely with The Assist Group, an NICU management company that provides care management, forensic hospital bill audits and a new service called EvalAssist.

Situation: Increase in NICU costs

One of our clients, ABC Health Plan, experienced a significant increase in NICU costs over the last 2 years without a corresponding increase in membership. Summit ReSources recommended that ABC Health Plan consider contracting with The Assist Group for EvalAssist. After an initial conversation with The Assist Group, ABC Health Plan decided to move forward with EvalAssist.

On-site assessment

The Assist Group provided an on-site assessment of ABC Health Plan's NICU medical management processes and staffing, NICU facility and professional contracts, and claims submission and payment processes. The Assist Group also provided care management services to several cases referred to The Assist Group by ABC Health Plan.

Over the course of several months, the staff of The Assist Group worked closely with ABC Health Plan to analyze claims data for the past two years and compare the billing patterns to the facility and provider contracts. The Assist Group neonatologists worked directly with the attending neonatologists to discuss the optimal treatment plans for cases referred to The Assist Group for care management oversight. The Assist Group also provided benchmark data regarding lengths of stay based on gestational age and birth weight.

Recommendations

After approximately 3 months, The Assist Group revisited ABC Health Plan to discuss the comprehensive assessment and provide recommendations to maintain or improve the NICU management while decreasing overall cost of care. The overall increase in cost that ABC Health Plan experienced over the last two years was determined to be related to several factors. The Assist Group identified each factor and made recommendations to improve financial outcomes while maintaining quality of care.

Changes

After the key factors for rising overall costs were identified, ABC Health Plan implemented the recommended changes. The Assist Group met with the attending neonatologists to discuss standards of NICU care, worked with ABC Health Plan’s provider contracting department to revise contracts as needed, and assisted the claims department in development of a forensic claims review process prior to payment of the claims.

NICU management has become costly and complex. If you are experiencing rising NICU costs and want to understand the reasons, it is sometimes cost effective to have an outside consultant, who is experienced in all aspects of NICU care, review your processes and possibly identify some factors that would make a difference in your bottom line.

“No Floors” Transplant Network

The most important consideration when choosing a transplant network should always be the quality of care delivered. A secondary but important consideration is the cost effectiveness of the network. Contracts for the U.R.N. Transplant Centers of Excellence network and Transplant Access Program (TAP) are structured in a variety of ways, allowing Summit Re customers referral options based on their desire for cost predictability. In order to assist in the contract selection process, U.R.N. has identified a subset of network contracts without floors and aggregated them into a “No Floors” network.

The U.R.N. "No Floors" network consists of programs with transplant contracts that eliminate the possibility of a transplant being paid at a percent of billed charges. This network consists of 51 centers and 237 transplant programs and increases the transparency of network providers without minimum payment provisions. This provides you with greater transplant cost predictability when using a “No Floors” network facility.

Information regarding the “No Floors” network, including a listing of the facilities, can be found on the U.R.N. website (www.urnweb.com) or you can contact Debbie Stubbs, RN, MS, CCM at 260-407-3979 or at dstubbs@summit-re.com.

Case studies from The Assist Group

The Assist Group specializes in solutions for catastrophic claims management and high-risk premature infants. Current products include CareAssist, a unique, physician-driven neonatal care management program, and ClinAssist, a powerful forensic audit and claims resolution service. The Assist Group has a proven track record for delivering financial value to clients. For more information about these products and services, please visit the company's website, www.assistgroup.com, or contact Debbie Stubbs, RN, MS, CCM at Summit Re, 260-407-3979.

CareAssist Success Story: 32 % Reduction in Length of Stay and $163,693 Savings

This twin boy was born at 25 weeks, weighing one pound, eight ounces. His mother used multiple illicit drugs throughout her pregnancy and on the day of delivery. He was on mechanical ventilation and in critical condition when referred to CareAssist on day of life (DOL) 17. This infant was not expected to survive due to his prenatal history, the circumstances of his birth, and extreme prematurity. The CareAssist neonatologist recommended an ethics committee consultation to discuss quality of life issues when it became evident on DOL 30 that he would survive. By then, this infant had the severest form of intraventricular hemorrhage, along with hydrocephaly and porencephaly. He also had severe chronic lung disease (CLD) and remained on mechanical ventilation well past his first month of life. His long-term prognosis was poor.

His final discharge disposition further complicated his clinical status as his mother continued to struggle with polydrug abuse and was considered unsuitable to care for him after discharge. CareAssist consistently recommended early discharge planning to allow a foster family to be trained to care for this infant upon discharge. This timely intervention allowed this baby boy to be discharged appropriately and safely.

Multiple oxygen weaning recommendations were made by the CareAssist neonatologist. This infant was eventually weaned to nasal cannula oxygen on DOL 59 and was discharged on low flow nasal cannula oxygen. This infant’s nutritional status was complicated by his CLD and tendency to tire during feedings secondary to his compromised pulmonary status. The steroids used to help wean him from supplemental oxygen also compromised his ability to gain weight. The CareAssist neonatologist emphasized to the treating team the importance of using high calorie formula and advised early developmental interventions through the use of non-nutritive sucking and OT/PT involvement in nipple training. As a result of these interventions, the infant was nippling all of his feedings at a corrected age of just 35 weeks.

The weekly care oversight by CareAssist for nearly three months ensured consistency in the implementation of this infant’s treatment plan. Due to CareAssist’s oversight, this infant was discharged safely to foster care 39 days earlier than originally anticipated. This resulted in a 32% savings of $163,693.

ClinAssist Success Story: $321,757 Savings

A 110-day confinement at a children’s hospital resulted in total billed charges of $1,287,027. ClinAssist reviewed approximately 10,600 line items of detailed charges. Utilizing the clinical expertise of ClinAssist’s neonatologists and nurses, ClinAssist performed a forensic review of the charges and identified the following exceptions:

- Room and board charges billed at incorrect levels of acuity

- Experimental pharmaceutical therapies

- Supplies and services incorrectly unbundled from the room and board charges

ClinAssist successfully achieved a $321,757 reduction in billed charges after the audit exceptions were presented to the facility. The account balance was adjusted to reflect the facility’s written agreement that the exceptions identified by ClinAssist were not payable charges.

Cost containment and more

Summit Re recently entered into an agreement with National Care Network (NCN) for its medical cost containment services. NCN’s core solutions for out-of-network claims include Fee Negotiations, Supplemental Network Repricing, and Hospital Detail Analysis, a Medicare-based pricing methodology.

Unmet Needs

While NCN had been extremely successful in saving its clients millions of dollars with these products, it realized that neither NCN nor other cost containment companies were doing enough to reduce overall healthcare charges. A new product was needed, a product which would:

- Allow fair reimbursement based on the facility’s costs to provide care

- Benchmark similar facilities reflecting the variances within facility costs

- Use flexible pricing methods to meet clients’ needs

- Recommend pricing that is transparent to the payer, provider and member

Data iSight

After a year and a half in development with Data Advantage, a company NCN acquired in 2005, NCN recently introduced Data iSight to meet all of those needs. Data iSight will generate fair reimbursement recommendations that generate legitimate savings. To do this, Data iSight leverages nationally recognized data sets to enhance provider understanding and acceptance; reviews both the financial and clinical components of a claim; incorporates cost-based awareness; and provides a transparency component for providers, payers and members.

About NCN

NCN, a privately held organization based in Irving, Texas, provides its services to large insurance carriers, self-funded organizations, third party administrators, HMOs, employer groups and reinsurance carriers across the country. NCN has achieved many milestones in its fourteen years of operation, including being the first in its industry to receive the URAC Core Accreditation, establishing HIPAA compliant EDI transactions, developing on-line tools for client access of claim tracking and reporting, and reviewing billions of dollars in medical charges.

NCN provides you with a dedicated team to ensure success in helping you meet your savings objectives. Visit NCN at its website, www.nationalcarenetwork.com, or contact Debbie Stubbs, RN, MS, CCM at Summit Re, 260-407-3979.

But what if you have no transplant contract?

Most health plans have contracts with hospitals or medical centers that perform organ and tissue transplants. And, through Summit Re, clients have access to U.R.N.’s Transplant Resource Networks and Transplant Access Program. Most reinsurance agreements provide more favorable coverage for organ and tissue transplants performed in “approved” facilities than for those performed in "unapproved" facilities. The health plan typically submits its contracted rates to the reinsurer during the underwriting process and the reinsurer determines if the contracts will be “approved” or not.

Standard approach

At Summit Re/Swiss Re, that’s our standard approach as well. We usually provide 90% coinsurance for approved contracts (we use the term “scheduled”) and 50% or 60% for unapproved or unscheduled contracts. We list the scheduled contracts on Exhibit A, part of our reinsurance agreement. We consider U.R.N.’s transplant network facility contracts to be scheduled. Usually those contracts our clients hold directly are also scheduled if they are similar to U.R.N.’s.

A potential problem

But what if a member needs to go to a facility that isn’t part of U.R.N.’s network and with which the health plan has no contract for transplants? When the plan tries to negotiate a rate for that member, how will the plan know how the reinsurer will view the arrangement?

Usually the plan won’t know unless the terms are submitted to the reinsurer for review in advance of the transplant, each and every time such a situation arises. This can be frustrating for the health plan and means additional work for the reinsurer.

Summit’s solution

At Summit Re, we recognized this issue early on and took steps to make things easier for you. We developed another exhibit, Exhibit B, which helps our clients determine their reinsurance overage for unscheduled transplants up front.

We list specific case rates we consider to be scheduled for each type of transplant. We show rates for inpatient hospital services only and rates that include professional services. We show a separate set of rates for children and a set for adults. We include rates for all three types of bone marrow/stem cell transplants – even those performed on an outpatient basis.

If the health plan can negotiate case rates that are equal to or are better than the ones shown on Exhibit B, then the claim is reimbursed at the higher coinsurance level. There’s no need to send anything to us for “approval.” You already know the level of coinsurance that applies.

Not a cap

There’s one more very important point to remember, though. The rates listed on Exhibit B do not represent limits on what we consider to be eligible amounts under the reinsurance agreement. They do not represent caps on case rates. Amounts in excess of the listed case rates are not excluded. If a health plan simply can’t negotiate a rate that is equal to or lower than the Exhibit B rate, it just means the claim would be reimbursed at the lower coinsurance level.

This is just another example of Summit Re’s putting into practice its “fairness” Founding Principle to produce balance sheet stability for you.

Clinical Notification Triggers

The clinical notice form should be used by the medical management staff to notify Summit Re of potential cases where Summit ReSources may be of assistance to you. Use the clinical notification triggers list as a guide. The list is not all inclusive, so feel free to submit a clinical notification on any case for which Summit Re may be of assistance to you.

Diagnosis

- High cost pharmacy, such as Flolan, Factor VII, Factor VIII, Cerezyme / ICD-9: 272.7, 286.0, 415.0, 416.0, 416.8

- Major burns with a potential for a prolonged hospitalization / ICD-9: 941.0, 942.0, 943.0, 945.0, 948.2-9

- ESRD/dialysis with monthly dialysis costs greater than $10,000 / ICD-9: V56.0, V56.8, V45.1

- Major injuries or multiple trauma with a potential for a prolonged hospitalization and/or acute rehabilitation admission

- Premature infants with one or more of the following:

- gestational age ≤ 24 weeks / ICD-9: 765.0

- severe congenital heart disease, e.g. hypoplastic left heat, Tetralogy of Fallot, etc. / ICD-9: 746.7, 746.01, 746.89, 745.2

- severe gastrointestinal anomalies, e.g. gastroschisis, omphalocele, necrotizing enterocolitis, short bowel syndrome, etc. / ICD-9: 756.79, 777.5, 777.8, 579.3, 756.79

- severe bronchopulmonary dysplasia requiring long term ventilator treatment / ICD-9: 770.7

Case Characteristics

- Out of network services with minimal or no negotiated discounts

- Billed charges that greatly exceed reasonable and customary for the services rendered – refer before the claim is paid

- Questionable charges, such as unbundling or experimental treatments

- Cases with the potential to exceed the reinsurance deductible

- Multiple inpatient stays

Submission Process for Clinical Notices

- Use the clinical notification triggers list as a guide for completion of clinical notifications submitted to Summit Re.

- It is recommended that the clinical notices be submitted from the medical management department as they are usually the department first notified of a request for services.

- Complete the Clinical Notification Form (all sections that apply to your case).

- Completed forms may be faxed to 260-469-3014, emailed via encrypted software to claims@summit-re.com, or mailed to Summit Reinsurance Services, 7030 Pointe Inverness Way, Suite 350*, Fort Wayne, IN 46804.

- In lieu of the clinical notification form, you may submit a report containing similar information.

*Address updated when this article was converted to this post in 2014.

Medicare Revenue Recovery ReSource

Medicare reimbursement is one of the top issues that our clients face, so we’ve identified a unique way to make your Medicare revenue recovery much less of a headache.

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.

Beam Partners, LLC specializes in helping healthcare plans recover additional Medicare premium by using custom software that combines your medical claims and pharmacy data to identify the medical records that qualify.

Morbidity-based payments

The Medicare Advantage program operates under a diagnosis-based risk adjustment system that pays higher monthly capitation rates for enrollees with higher morbidity levels. Diagnosis codes extracted from medical claims are submitted to Centers for Medicare and Medicaid Services (CMS). CMS uses these diagnoses to assign enrollees to disease categories. The problem is that medical claims often do not reflect the enrollees’ true morbidity:

- Only a fraction of the diseases and conditions documented in the medical record ever make it to the claim form or record submitted to the health plan.

- New enrollees often have inadequate claims information.

- Inadequate diagnosis coding is common because diagnosis codes rarely factor into the claims adjudication process.

Every disease not submitted to CMS that is included in the CMSHCC (Hierarchical Condition Categories) model represents lost revenue. This lost revenue is most acute for patients with comorbidities, who are likely to require a disproportionate share of your resources.

Lost Opportunity

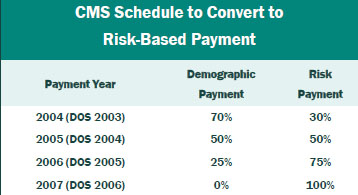

If you have not reviewed medical records for additional HCCs in the past two years, you may have given up significant revenue. The portion of the capitation payment attributable to medical diagnosis is being phased in by Medicare Revenue Recovery ReSource CMS through 2007, at which time 100% of the premium payment will be risk based. The table gives the transition schedule.

Results

Working closely with your staff, Beam clinical staff assesses data and medical charts to maximize recovery of lost premium. The results can be substantial. Based on its experience, Beam Partners estimates recoveries of about $3 million for every 10,000 members in the Medicare plan. Therefore, for plans with 25,000 members, approximately $7.5 million of additional recoveries is typical.

Contact: Your Summit Re account manager or Brian Fehlhaber, VP, Sales and Marketing at 260-469-3004 or bfehlhaber@summit-re.com.