Summit Reinsurance Services, Inc. today announced a strategic collaboration with RxResults, a pharmacy risk manager. Through this collaboration, Summit Re clients will have access to proprietary informatics, clinical expertise, and business processes to help formulate actionable insights and implement evidence-based strategic initiatives in order to manage pharmacy and specialty pharmacy spend.

Read moreSummit Re Announces Collaboration with Deerwalk, Inc.

Summit Reinsurance Services, Inc. today announced a strategic collaboration with Deerwalk, Inc., an innovative population health management, data management, and healthcare analytics software company. Through this collaboration, Summit Re clients will have access to the most complete population health management suite in the industry. Efficient and accurate data collection, intake, enrichment, and reporting, will allow participating clients to obtain a full picture of their risk portfolio in order to make more effective management decisions.

Read moreTransplantation and Expanded Criteria Donors: Hepatitis C

This shortage of available organs has led to the increased use of Expanded Criteria Donors in transplant centers for many different organs. This article discusses liver transplant recipients who are hepatitis C negative and receive a liver from an expanded criteria liver donor who is Hepatitis C positive.

Read moreSummit ReSources 2018 Outcomes

Summit ReSources helped clients realize more than $30 million in savings for 2018.

Read moreEligibility – Best Practices for Health Insurers

Healthcare reform will continue to require more responsibility from employers – especially small employers – which will, in turn, require more oversight by insurers. If employer groups are not properly enrolling, verifying eligibility, and reporting members, the health plan could find itself at risk with its reinsurer. The best way to avoid potential conflicts is to make sure your master contract is clear – and then to enforce it.

Read moreSummit Moves Forward with Zurich Strategic Alliance

This special edition of Summit Perspectives provides an in-depth explanation of the new Summit Re partnership with Zurich American Insurance Company for catastrophic medical excess of loss business across all product lines.

Read moreAbout Zurich

Zurich Insurance Group (Zurich) is a leading multi-line insurer that serves its customers in global and local markets. With more than 55,000 employees, it provides a wide range of general insurance and life insurance products and services. Zurich’s customers include individuals, small businesses, and mid-sized and large companies, including multinational corporations, in more than 170 countries. The Group is headquartered in Zurich, Switzerland, where it was founded in 1872. The holding company, Zurich Insurance Group Ltd (ZURN), is listed on the SIX Swiss Exchange and has a level I American Depositary Receipt (ZURVY) program, which is traded over-the-counter on OTCQX. Further information about Zurich is available at www.zurich.com. In North America, Zurich is a leading commercial property-casualty insurance provider serving the global corporate, large corporate, middle market, specialties and programs sectors through the individual member companies of Zurich in North America, including Zurich American Insurance Company. Life insurance and disability coverage issued in the United States in all states except New York is issued by Zurich American Life Insurance Company, an Illinois domestic life insurance company. In New York, life insurance and disability coverage is issued by Zurich American Life Insurance Company of New York, a New York domestic life insurance company. For more information about the products and services it offers and people Zurich employs around the world go to www.zurichna.com. 2012 marked Zurich's 100 year anniversary of insuring America and the success of its customers, shareholders and employees.

Zurich Financial Strength

Financial strength ratings (as of September 30, 2014): A.M. Best > A+/Stable

Standard & Poor's > AA-/Stable

Recognition and awards:

Zurich named “Best Insurance Company” (Captive LIVE USA Conference, October 2014)

2014 Innovation Award: “What if?” Zurich Risk Grading™ Application (Business Insurance, March 2014)

Zurich winner of the AGC Community Award (Associated General Contractors of America, Annual Conference, March 2014)

2014 Innovation Showcase: “Zurich Risk Room” and “My Zurich Portal” (Best’s Review magazine, January 2014)

Zurich “Best Political Risk Insurer,” “Best Global Supply Chain/Trade Disruption Insurer,” “Best Property Insurer,” “Best D&O Insurer,” “Best Employment Practices Liability Insurer,” “Best Crime/Fidelity Insurer” and “Best General Liability Insurer” (Global Finance Magazine, October 2013)

Zurich’s Trade Credit and Political Risk group named “Best Private Insurer in Trade,” “Best Trade Insurer in North America,” “Best Trade Insurer in Asia Pacific” and “Best Trade Insurer in Latin America” (Trade Finance, June 2013)

2013 Innovation Award: Zurich Risk Room Mobile Application (Business Insurance, March 2013)

2013 “Innovation in Fronting” Award: UK Captive Services Awards (Captive Review, February 2013)

Zurich named “Best Fronter of the Year” (Captive LIVE USA Conference, September 2012)

Zurich’s Trade Credit and Political Risk group named “Best Private Insurer,” “Best Trade Insurer in Asia Pacific” and “Best Trade Insurer in North America” (Trade Finance, August 2012)

Zurich named “2011 Insurer of the Year” (Daimler Financial Services AG, August 2012)

Innovation Award for Zurich Multinational Insurance Application (Zurich MIA) (Business Insurance, March 2012)

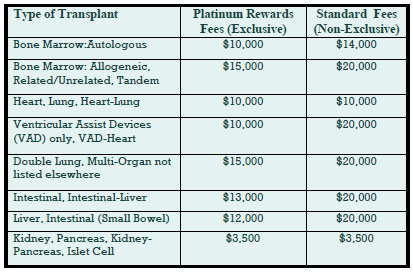

Deep Discounts on Transplant Program Fees

Deeply discounted transplant access fees are available through our new Platinum Rewards program, an enhanced OptumHealth Care Solutions (formerly United Resource Networks) program. This program is available only to Summit Re’s clients. Under our previous program, you received a 5% discount on network access fees, an additional 5% discount if you agreed only to use OptumHealth’s networks, and up to 10% based on Summit Re’s total volume of business with OptumHealth. The third discount was calculated retrospectively.

These three potential discounts are now bundled into one substantial discount. The program is easier to use and easier to understand. You will be able to realize the total savings we've negotiated “up front” through reduced access fees.

The savings from the Platinum Rewards program can be significant, as shown in the chart. Based on our historical case mix, the Platinum Rewards program represents an effective 27% discount off standard OptumHealth fees.

To be eligible for Platinum Rewards, you must agree only to use the OptumHealth networks for your transplants, although you can still “carve out” facilities with which you have your own contracts.

The new program is effective on January 1, 2008. You will need to execute a new Payer Access Agreement, selecting either the fees for the Platinum Rewards program or the standard access fees.

Platinum Rewards Frequently Asked Questions

Which of the OptumHealth programs will be subject to the reduced fees?

The reduced fees apply to the Transplant Resource Services’ Centers of Excellence program and the Transplant Access Program for business that is reinsured through Summit Re. All other OptumHealth program fees remain unchanged.

Do the reduced fees apply to both adult and pediatric transplants?

Yes, the reduced fees apply to adult and pediatric transplants.

How will the Platinum Rewards program affect the OptumHealth transplant facility contracts and services?

The new program has the same facility contracts and services contained under the current OptumHealth programs.

Will I be able to “carve out” a specific facility from the OptumHealth contract and use my own contract at that OptumHealth facility?

You will still have the capability of carving out a facility or facilities from the OptumHealth agreement. Those facilities should be listed on Exhibit C of the Payer Access Agreement.

What happens if I want to use another transplant network in addition to OptumHealth?

You may use another network in addition to OptumHealth. However, if you do so, you will not be eligible for the reduced fees available through the Platinum Rewards program. You will pay OptumHealth’s standard access fees.

What do I need to do to initiate the new program?

If you are currently accessing OptumHealth through Summit Re, you will need to sign a new Payer Access Agreement. New Payer Access Agreements will be mailed to Summit Re clients. Be sure to indicate if you intend to use the OptumHealth network only or if you will use another network in addition to OptumHealth’s network.

Will I still receive this year’s discount based on Summit Re’s total volume of business with OptumHealth?

You will still be eligible for the discount for 2007 based on Summit Re’s total volume of business with OptumHealth, provided you are a Summit Re client at the time the refund is paid. OptumHealth has committed to paying this refund within 60 days after the end of the calendar year.

ERC / Westport Merger

Swiss Re has received regulatory approval to merge Westport Insurance Corporation into Employers Reinsurance Corporation. The merger is an example of Swiss Re’s focus on smart capital management, delivering greater efficiency and reducing operating costs. Reinsurance agreements issued after January 1, 2008 will bear the Westport name. There will be no changes in coverage as a result of the merger. If you have any questions, please contact Summit Re at 260-469-3000.