Deeply discounted transplant access fees are available through our new Platinum Rewards program, an enhanced OptumHealth Care Solutions (formerly United Resource Networks) program. This program is available only to Summit Re’s clients. Under our previous program, you received a 5% discount on network access fees, an additional 5% discount if you agreed only to use OptumHealth’s networks, and up to 10% based on Summit Re’s total volume of business with OptumHealth. The third discount was calculated retrospectively.

These three potential discounts are now bundled into one substantial discount. The program is easier to use and easier to understand. You will be able to realize the total savings we've negotiated “up front” through reduced access fees.

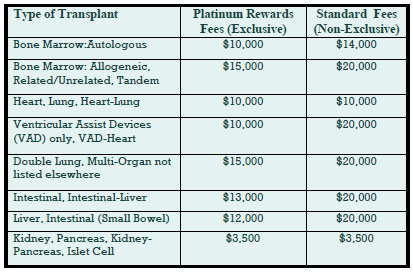

The savings from the Platinum Rewards program can be significant, as shown in the chart. Based on our historical case mix, the Platinum Rewards program represents an effective 27% discount off standard OptumHealth fees.

To be eligible for Platinum Rewards, you must agree only to use the OptumHealth networks for your transplants, although you can still “carve out” facilities with which you have your own contracts.

The new program is effective on January 1, 2008. You will need to execute a new Payer Access Agreement, selecting either the fees for the Platinum Rewards program or the standard access fees.

Platinum Rewards Frequently Asked Questions

Which of the OptumHealth programs will be subject to the reduced fees?

The reduced fees apply to the Transplant Resource Services’ Centers of Excellence program and the Transplant Access Program for business that is reinsured through Summit Re. All other OptumHealth program fees remain unchanged.

Do the reduced fees apply to both adult and pediatric transplants?

Yes, the reduced fees apply to adult and pediatric transplants.

How will the Platinum Rewards program affect the OptumHealth transplant facility contracts and services?

The new program has the same facility contracts and services contained under the current OptumHealth programs.

Will I be able to “carve out” a specific facility from the OptumHealth contract and use my own contract at that OptumHealth facility?

You will still have the capability of carving out a facility or facilities from the OptumHealth agreement. Those facilities should be listed on Exhibit C of the Payer Access Agreement.

What happens if I want to use another transplant network in addition to OptumHealth?

You may use another network in addition to OptumHealth. However, if you do so, you will not be eligible for the reduced fees available through the Platinum Rewards program. You will pay OptumHealth’s standard access fees.

What do I need to do to initiate the new program?

If you are currently accessing OptumHealth through Summit Re, you will need to sign a new Payer Access Agreement. New Payer Access Agreements will be mailed to Summit Re clients. Be sure to indicate if you intend to use the OptumHealth network only or if you will use another network in addition to OptumHealth’s network.

Will I still receive this year’s discount based on Summit Re’s total volume of business with OptumHealth?

You will still be eligible for the discount for 2007 based on Summit Re’s total volume of business with OptumHealth, provided you are a Summit Re client at the time the refund is paid. OptumHealth has committed to paying this refund within 60 days after the end of the calendar year.